Managing your finances can be overwhelming, but having a printable checkbook reconciliation sheet can make it easier to keep track of your expenses. By using a simple tool like this, you can stay organized and ensure that your bank account is balanced.

Whether you prefer to write everything down in a physical notebook or use a digital spreadsheet, having a reconciliation sheet handy can help you avoid any discrepancies in your finances. It’s a great way to track your spending, monitor your account activity, and catch any errors before they become larger issues.

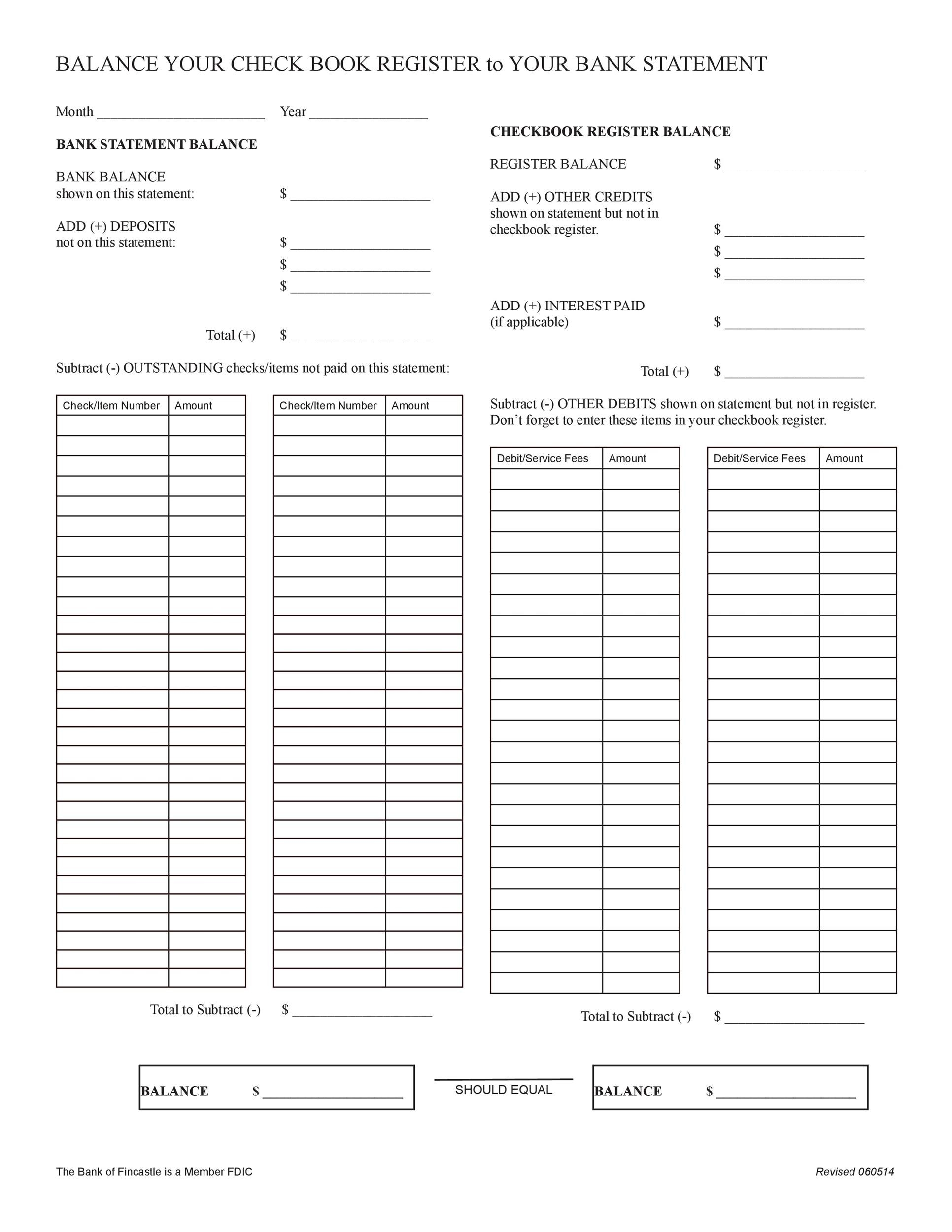

Easy Printable Check Book Reconciliation Sheet

Easy Printable Check Book Reconciliation Sheet

Creating your own checkbook reconciliation sheet is easy. Simply list all of your transactions, including checks written, deposits made, and any other withdrawals or fees. Then, compare this information to your bank statement to ensure that everything matches up.

By regularly reconciling your checkbook, you can identify any discrepancies or fraudulent activity quickly. This can help you avoid overdraft fees, prevent identity theft, and maintain a clear understanding of your financial health. Taking a proactive approach to managing your finances is key to long-term success.

Using a printable checkbook reconciliation sheet is a straightforward way to stay on top of your finances. It can give you peace of mind knowing that your records are accurate and up to date. Plus, it’s a great tool for budgeting and setting financial goals.

So, next time you sit down to review your finances, consider using a printable checkbook reconciliation sheet to make the process easier and more efficient. With this simple tool, you can take control of your money and set yourself up for financial success.

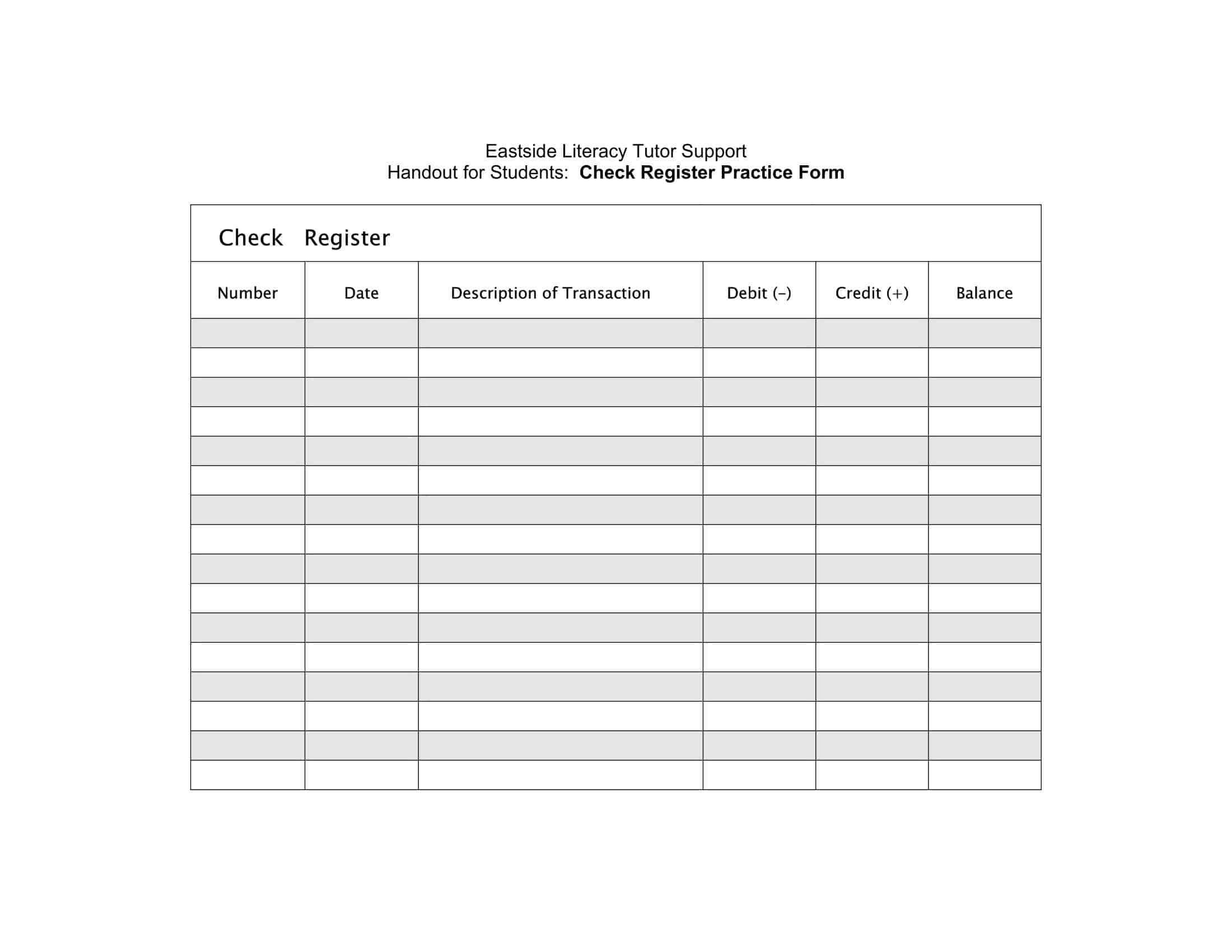

Free Printable Checkbook Register Templates PDF Excel

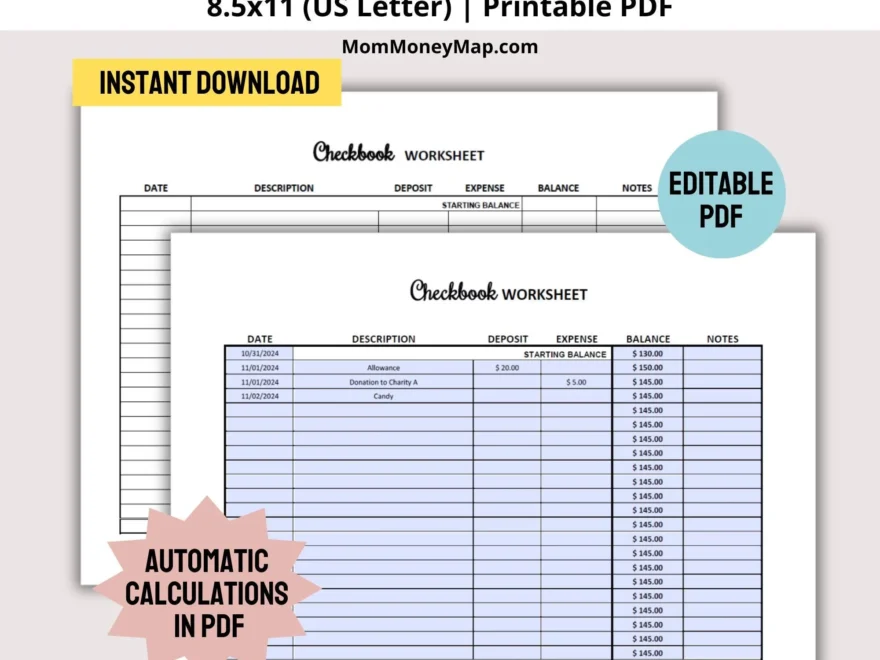

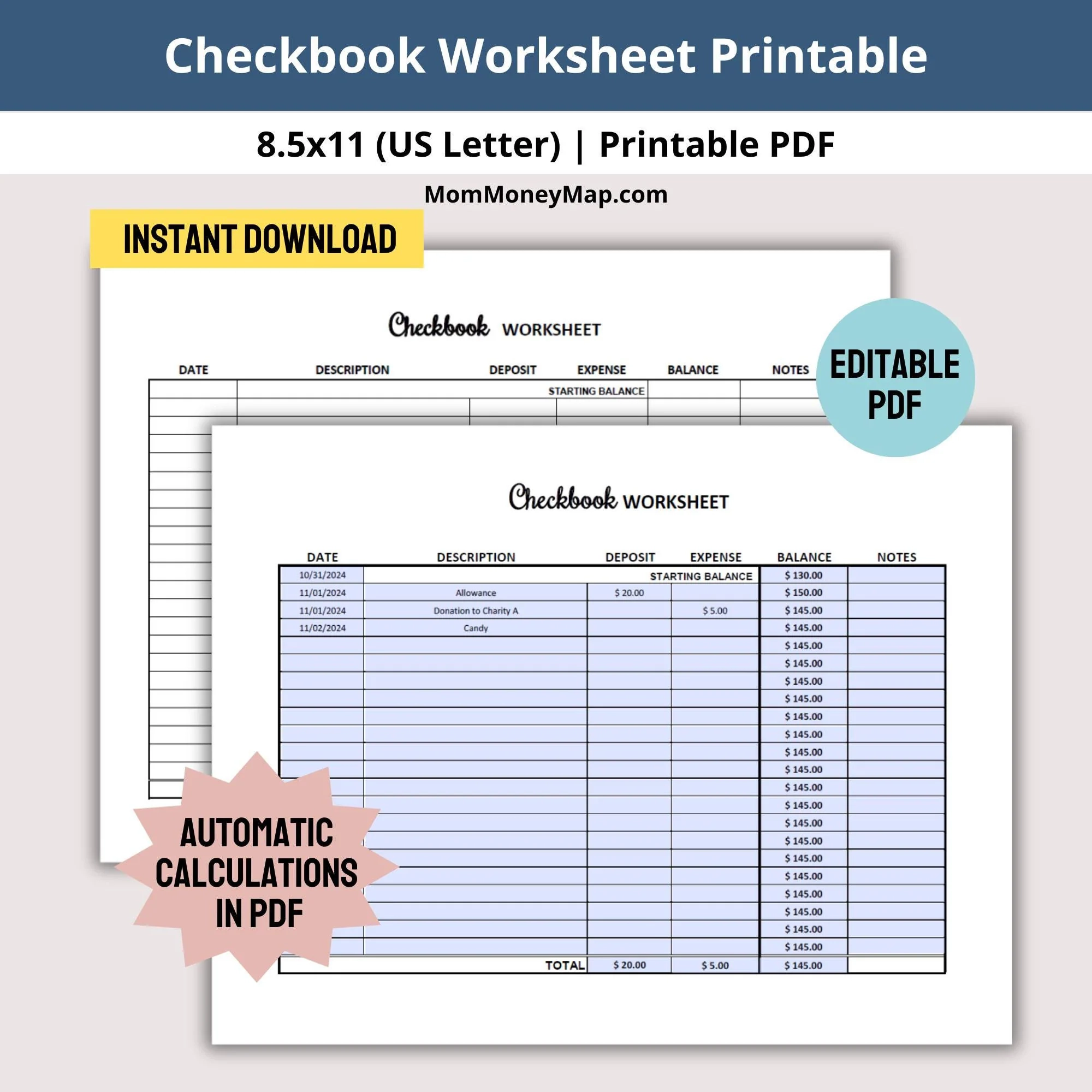

Checkbook Worksheet Printable PDF Check Register Reconciliation Worksheet Worksheet To Balance Checkbook Checkbook Balance Sheets PDF Etsy